ACH and Same Day ACH Growth Metrics: Q1 2025 Performance at Payliance

As lenders and merchants modernize their payment infrastructure, adoption of faster, more efficient payment rails continues to accelerate. At Payliance, our Q1 2025 results reflect significant year-over-year growth across both standard ACH and Same Day ACH channels.

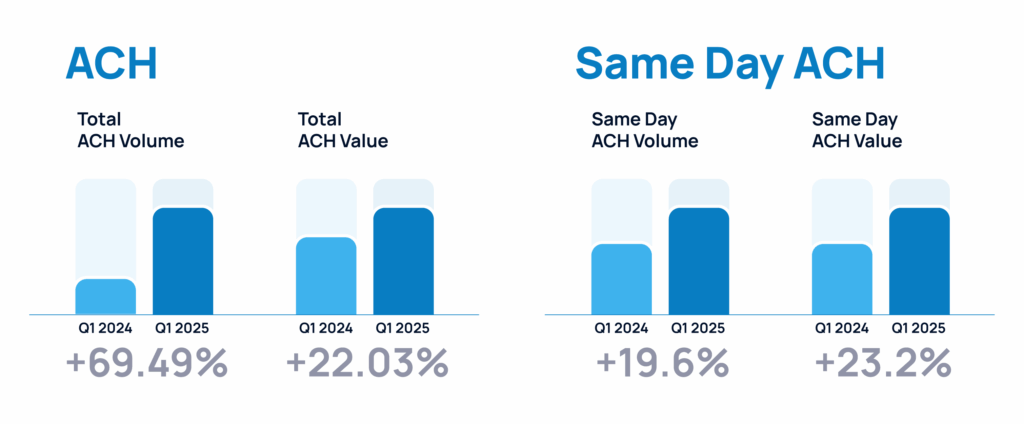

Our Q1 2025 metrics:

- ACH transaction volume: +69.5% YoY

- ACH payment value: +22.0% YoY

- Same Day ACH volume: +19.6% YoY

- Same Day ACH value: +23.2% YoY

These gains reflect our recent acquisition of EFT Network and underscore how lenders and merchants are scaling faster payments, particularly Same Day ACH, for disbursements, collections, and borrower experience improvements. ACH remains the backbone of high-volume payment operations, while Same Day ACH adoption continues to grow for time-sensitive use cases.

When to Use ACH vs. Same Day ACH: Best Practices for Lenders

Standard ACH and Same Day ACH operate on the same rails but serve different purposes:

Standard ACH: Cost-Efficient, Reliable, and Ideal for Recurring Transactions

Standard ACH supports next-day settlement, which is ideal for scheduled repayments or disbursements where timing is predictable. It remains a cost-effective backbone for high-volume payment flows.

ACH is best for recurring or predictable payments, such as:

- Loan repayment drafts

- Scheduled disbursements

- Vendor payouts

Same Day ACH: Critical for Time-Sensitive Funding or Repayments

Same-day ACH supports near-real-time settlement, typically within hours. With a transaction limit of $1 million, it’s ideal for urgent payouts like payroll corrections, last-minute loan funding, or time-sensitive borrower repayments. It helps lenders increase borrower satisfaction while improving internal cash flow management.

Same Day ACH is ideal for:

- Last-minute loan disbursements

- Emergency payroll or refunds

- Same-day borrower repayment confirmation

Standard ACH and Same Day ACH share the same underlying infrastructure but serve different timing needs. While standard ACH typically settles on the next business day, Same Day ACH provides settlement within hours through three daily processing windows. This distinction creates strategic opportunities for lenders:

Expanded Capabilities Through Strategic Integration

In alignment with acquisition and integration to the EFT Network, Payliance is actively unifying the strengths of both platforms to enhance our capabilities across ACH and Same Day ACH processing. Key advantages for lenders include:

- Faster access to new payment types via flexible APIs

- Improved capacity for growing transaction volumes

- Streamlined payment ops through a single platform

This creates a future-ready ACH payment processing environment for lenders operating in a highly regulated space.

Risk Management for Faster ACH Transactions

Faster payments require more innovative controls. That’s why VeriTrac® Bank Account Verification supports every ACH and Same Day ACH transaction on our platform.

Benefits include:

- Real-time consumer account validation

- Risk flags for non-compliant or high-return accounts

- Built-in Nacha compliance for WEB debit originations

- Lower return and administrative costs

This ensures lenders can scale Same Day ACH confidently, with minimal operational risk.

Trends in Faster Payments: How Payliance Aligns with Nacha’s Vision

The payments landscape continues to evolve, with enhanced capabilities being implemented on existing platforms and the introduction of new rails. Industry initiatives like Nacha’s Faster Payments Experience focus on same-day, immediate, and other faster payments innovations, creating new opportunities for payment participants.

Payliance remains at the forefront of these developments, helping lenders implement strategic payment solutions that balance:

Unified ACH, Card, and Same Day Payment Platform: Key Capabilities

A sophisticated payment strategy incorporates ACH, Same Day ACH, and card processing, using each where most advantageous. This multi-rail approach enables lenders to optimize for different scenarios, from scheduled recurring payments to real-time authorizations.

Our expanded platform supports:

- Consolidated reconciliation across ACH, cards, and Same Day ACH

- A single API for initiating and tracking all payment types

- Real-time validation and compliance monitoring

- Intelligent routing for lowest-cost transaction processing

How Lenders Can Leverage Faster Payments for Growth in 2025

With over 162 million transactions processed annually and $61 billion in volume across 350+ lenders and 40,000+ merchant locations, Payliance delivers:

- Faster loan disbursement options with Same Day ACH

- Lower-cost alternatives to card rails through ACH

- Built-in Nacha compliance and account validation

- Tools to reduce returns, improve borrower satisfaction, and enhance cash flow

Ready to Accelerate Your Payment Strategy?

As borrower expectations shift and faster payment adoption grows, lenders need a partner to simplify complexity while unlocking strategic advantage. Contact our team to explore how Payliance’s ACH and Same Day ACH payment solutions can support your 2025 growth strategy. Get started today.

Stay in the know

"*" indicates required fields